How much should I pay for car insurance in Edmonton?

Car Insurance In Edmonton: According to the latest data released by the Insurance Bureau of Canada, Albertans pay an average of $1,316 per year for their car insurance premium, equivalent to a monthly payment of $109.67. Alberta operates on a private car insurance system, which encourages competitive rates between insurance providers and helps keep prices down. The cost of your

What are the different types of home insurance coverage?

Home insurance coverage exists to protect: Your dwelling, including the outdoor structures such as the garage, shed, or gazebo Your contents inside the home and outdoor structures Yourself, also known as personal liability protection Whether you own or rent a house, apartment, or condo, home insurance ensures that your assets are covered and that you’re protected from financial liability. In

What are the benefits of hiring an auto insurance broker?

Most people renew their auto insurance policies without giving much thought to the opportunities and cost-saving benefits they could be missing out on. Auto insurance is required in Alberta, so it’s not a question of whether to get insurance, but rather which policy will give you the best value for your money. If you don’t read through your entire policy,

The importance of agricultural insurance

When it comes to the business of agriculture, insurance is not just a means of protection against major events, loss, and damage. Few industries are as heavily affected by unpredictable weather, fluctuations in supply and demand, and day-to-day operational challenges. For this reason, agricultural insurance becomes a valuable risk management tool that allows farmers to plan for the future while

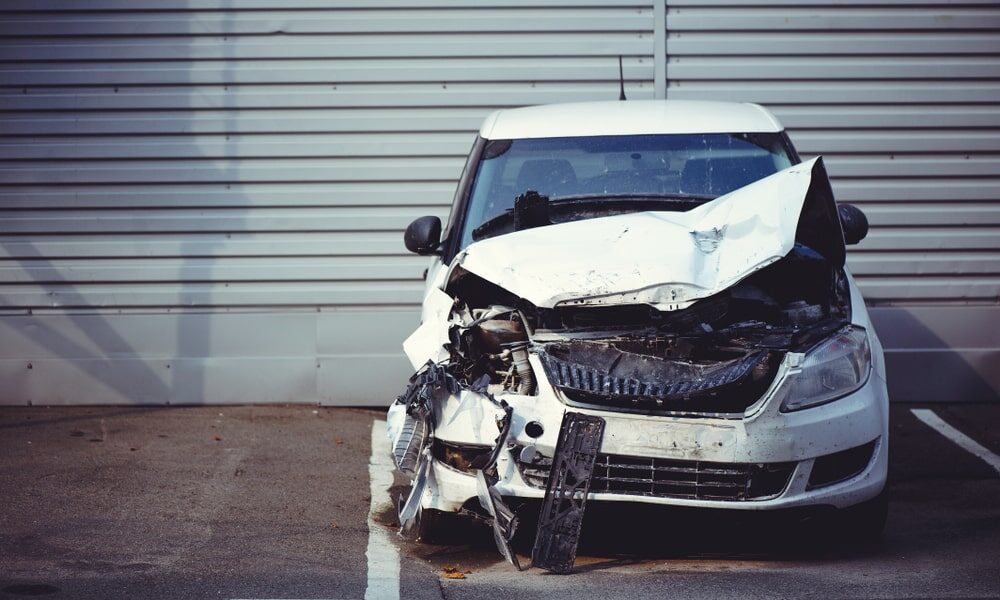

What happens if you get into a parking lot accident in Alberta?

Parking lot collisions are more common than people realize. While most parking lot accidents are minor, serious damage and injury can still occur. Some examples of common parking lot collisions are: A car hitting a legally parked vehicle A vehicle colliding with a stationary object A car hitting a pedestrian or cyclist Two moving vehicles backing up and colliding with

Drunk Driving and Insurance – What You need to Know

In Alberta, all auto insurance policies have the same three sections as provided by the provincial government: • Third Party Liability • Accident Benefits • Physical Damage How does drunk driving affect insurance? To address the subject of drunk driving and car insurance in Edmonton, we need to look at each section and how it affects a drunk driver in

The Importance of Tenant Insurance

When you rent a house, condo, or apartment, your landlord is responsible for having adequate insurance for the building. However, their insurance policy won’t cover your personal property and additional living expenses in the event of a claim. Tenant insurance is affordable and easy to purchase coverage that is designed specifically for renters that protects them against financial liability against

What are the Advantages and Limitations of Cyber Insurance?

The threat of data breaches in today’s digital era poses a unique set of challenges for all companies in every industry. Unlike business insurance that protects tangible property, cyber insurance provides an additional measure of security. To help offset the cost of data breaches, a growing number of companies are turning to cyber insurance for protection. Before investing in cyber

Driving with an Out of Province Plate

Driving your car out of the province for an extended period of time is generally not a serious issue and shouldn’t affect your current car insurance. However, there are certain guidelines and circumstances that require notifying your insurance company or broker to ensure that you are properly protected while driving your vehicle in a different city. When to call your

What is Recreational Vehicle Insurance When It Comes to having an Insurance Policy?

Recreational vehicle insurance includes motorhomes, travel trailers, tent trailers, and fifth wheels. If your RV is damaged or destroyed, recreational insurance covers your expenses and is separate from your car insurance policy. If you own an RV or motorhome, it’s important to understand that there are two types of RV insurance policies available. One policy is for motorhomes that are